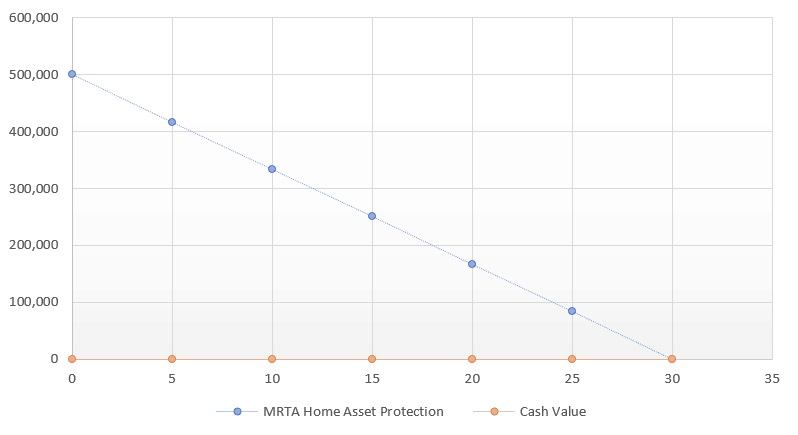

Mortgage Reducing Term Assurance (MRTA)

Protection: MRTA gives you protection which reduces over time until it reaches zero. MRTA was compulsory in the past. However, today, you have more flexibility on choosing your property asset risk planning.

Durations: 5 - 35 years (up to maximum home loan duration)

Cost: Approximately RM3,500 for every RM100,000 protection. (One time payment / Lump Sum)

| Pros | Cons |

|---|---|

| MRTA is lower cost in terms of total premium | MRTA in Malaysia does not cover critical illnesses (only death and Total Permanent Disability [TPD]) |

| MRTA can be bundle together with your home loan to reduce additional cash expenses | No Cash Value. Even if you cancel earlier, your may get back only a small % of premium paid (closer to zero when nearning the last year of MRTA) |